Fearless: Wilma Soss and America’s Forgotten Investor Movement

SHIPS WEEK OF AUGUST 30th

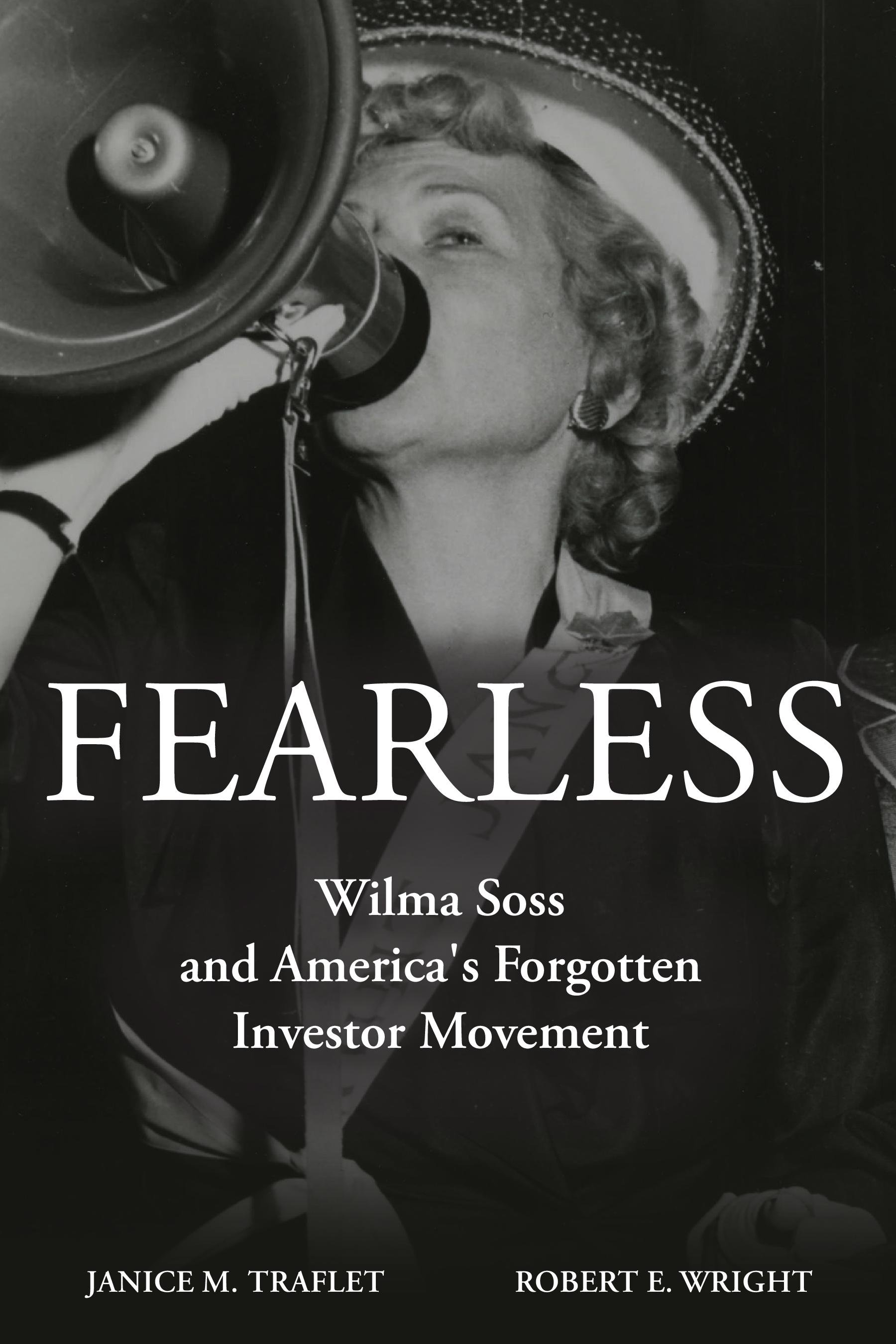

Shareholder activist Wilma Soss rocketed to fame in the 1950s fighting for the rights of the individual investor. But over the years, her legacy was almost forgotten.

Based on archival documents, Fearless is the true story of how a disparate group of activist investors—from a PR star to a Holocaust survivor—found each other and became the advocates Fortune 500 management loved to hate.

Soss and her band of activists, including the incomparable Evelyn Y. Davis, leveraged the media to promote the rights of small shareholders. The idea was simple: buy one share of stock to gain access to shareholder meetings and remind management whom they really serve.

These “corporate gadflies” were determined to speak their minds, even if it meant bringing their own megaphones or being dragged out of public meetings. But their message was undeniable, and ultimately changed corporate America for the better. Increased opportunities in the workplace, improved shareholder voting rights and greater corporate transparency were just some of the reforms Wilma Soss and her Federation kicked off in the post-war era.

If you’re looking for the intellectual heritage of 2021’s WallStreetBets phenomenon or the reason Fearless Girl stands as a symbol of American optimism today, look no further than the life, times and efforts of the fearless shareholder activist, Wilma Soss.

SHIPS WEEK OF AUGUST 30th

Shareholder activist Wilma Soss rocketed to fame in the 1950s fighting for the rights of the individual investor. But over the years, her legacy was almost forgotten.

Based on archival documents, Fearless is the true story of how a disparate group of activist investors—from a PR star to a Holocaust survivor—found each other and became the advocates Fortune 500 management loved to hate.

Soss and her band of activists, including the incomparable Evelyn Y. Davis, leveraged the media to promote the rights of small shareholders. The idea was simple: buy one share of stock to gain access to shareholder meetings and remind management whom they really serve.

These “corporate gadflies” were determined to speak their minds, even if it meant bringing their own megaphones or being dragged out of public meetings. But their message was undeniable, and ultimately changed corporate America for the better. Increased opportunities in the workplace, improved shareholder voting rights and greater corporate transparency were just some of the reforms Wilma Soss and her Federation kicked off in the post-war era.

If you’re looking for the intellectual heritage of 2021’s WallStreetBets phenomenon or the reason Fearless Girl stands as a symbol of American optimism today, look no further than the life, times and efforts of the fearless shareholder activist, Wilma Soss.

SHIPS WEEK OF AUGUST 30th

Shareholder activist Wilma Soss rocketed to fame in the 1950s fighting for the rights of the individual investor. But over the years, her legacy was almost forgotten.

Based on archival documents, Fearless is the true story of how a disparate group of activist investors—from a PR star to a Holocaust survivor—found each other and became the advocates Fortune 500 management loved to hate.

Soss and her band of activists, including the incomparable Evelyn Y. Davis, leveraged the media to promote the rights of small shareholders. The idea was simple: buy one share of stock to gain access to shareholder meetings and remind management whom they really serve.

These “corporate gadflies” were determined to speak their minds, even if it meant bringing their own megaphones or being dragged out of public meetings. But their message was undeniable, and ultimately changed corporate America for the better. Increased opportunities in the workplace, improved shareholder voting rights and greater corporate transparency were just some of the reforms Wilma Soss and her Federation kicked off in the post-war era.

If you’re looking for the intellectual heritage of 2021’s WallStreetBets phenomenon or the reason Fearless Girl stands as a symbol of American optimism today, look no further than the life, times and efforts of the fearless shareholder activist, Wilma Soss.

Author

Business historian Janice M. Traflet (Ph.D., Columbia University) explores in her research many facets of Wall Street history, especially how ordinary citizens have interacted with the securities markets over time. She is the author of the well-acclaimed book A Nation of Small Shareowners (Johns Hopkins), in addition to numerous articles in journals such as Business History, Journal of Business Ethics, Journal of Cultural Economy and Essays in Economic and Business History. She serves on the Financial History editorial board, in addition to the board of the Economic and Business History Society. She teaches in the Freeman College of Management at Bucknell University.

Policy historian Robert E. Wright (Ph.D., SUNY Buffalo) has (co)authored 24 books, including The First Wall Street (Chicago 2005), One Nation Under Debt (McGraw Hill 2008), and The Wall Street Journal Guide to the 50 Economic Indicators That Really Matter (HarperCollins 2011). He taught courses in business, economics, and policy at Temple, Virginia, New York, and Augustana universities before joining the American Institute for Economic Research in January 2021. He has appeared on C-SPAN, Fox Business, and other broadcast outlets and been featured in Barron’s, Los Angeles Times, New York Times, Wall Street Journal, and Washington Post.

Praise & Reviews

“I strongly believe that capitalism works, and that it can work for anybody and everybody. Wilma Soss believed it too and advocated for every shareholder. This book captures the rich history of her life and life's work. It’s a must read for anyone who believes in our market system. The world belongs to risk takers, and Wilma Soss was one of them!”

— Ken Langone, co-founder, The Home Depot and author of I Love Capitalism

“If you don't know about Wilma Soss then you should, and the best way to do that is to read Traflet and Wright's new book. A corporate gadfly, broadcast journalist, and first-rate economic prognosticator, Soss was a pioneer for women's rights. She was the original "Woman of a Million Words" in an era when women's voices rarely got heard in boardrooms or on the airwaves. Her story is one that needs telling now at a time when we need strong role models to help inspire us. The authors bring her back to life, and then some.”

— Simon Constable, financial commentator and coauthor of The Wall Street Journal Guide to the 50 Economic Indicators That Really Matter

“Fearless leaves the reader energized to continue Wilma Soss’ efforts. Wilma leveraged her savvy PR and journalism skills to forge a “road not taken”; a pioneer in advocating for Social and Governance of today’s “ESG”; relentlessly fighting for skilled women on corporate boards, corporate accountability, financial literacy for all, women’s shareholder rights and their financial empowerment. Traflet and Wright pack the book with exciting scenes of intense shareholder meetings, animated corporate gadflys and enlightening statistics.”

— Allison Adams, former Managing Director and Publisher of the Institutional Investor Journals including The Journal of Portfolio Management

“Janice Traflet and Robert Wright's new book is an entertaining, fast-paced account of one of the unsung heroes of the modern American economy, Wilma Soss, who fought for shareholder rights and womens' economic empowerment across much of the twentieth century. As demands for corporate social responsibility and diverse business leadership again come to the fore, it's high time to rediscover this trailblazing activist, "gadfly," and journalist. Highly recommended.

— Harwell Wells, corporate governance expert and law professor, Temple University

“The book seamlessly combines financial history, Hollywood, Broadway, shareholder activism, and women's issues in a way that illuminates the past and contributes to current debates. The authors provide a multifaceted and realistic portrayal of many of the struggles for equality and inclusion in 20th century America. Delve into it. You will not be disappointed.”

— Sonali Garg, economics Ph.D. and financial historian based in India.

“I am grateful to the authors for this meticulously researched, lively, and engaging biography of pioneering shareholder activist Wilma Soss, long overdue for recognition as a true visionary of corporate governance. Her insight, determination, and superb communication skills made her a towering figure in what has become a true revolution in shareholder engagement with corporate executives and board members who for too long forgot that capitalism is named after the shareholders. Wilma Soss, along with the Gilbert brothers and a handful of others, some very colorful, who are skillfully woven into the story, was there to remind them that shareholders are watching and will speak up if their interests are overlooked. She was often dismissed as a gadfly. But remember; the gadfly may be tiny, but she can make an enormous animal move.

— Nell Minow, shareholder advocate and Vice Chair ValueEdge Advisors